Reesecure

Turn climate risk into clarity.

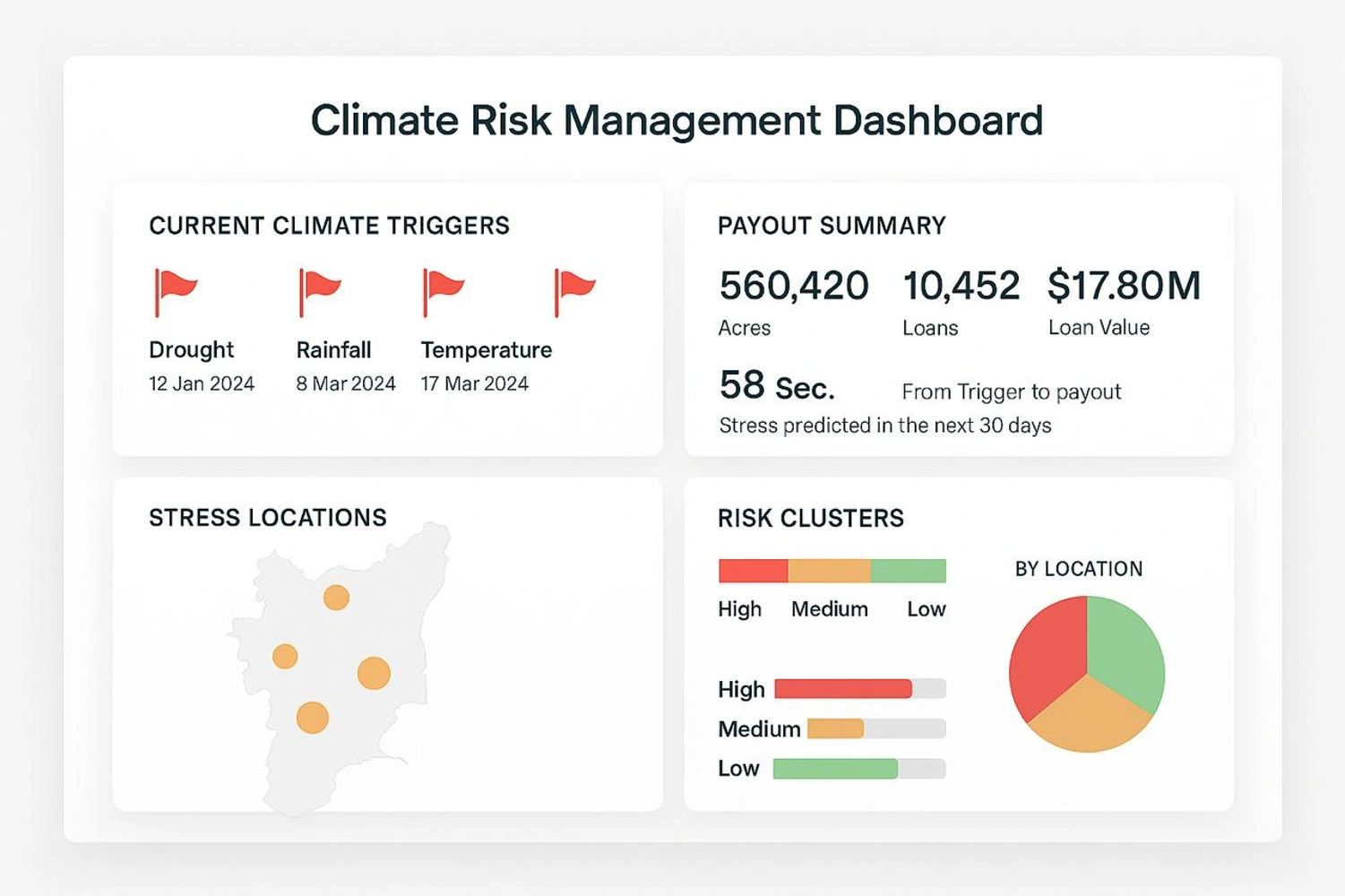

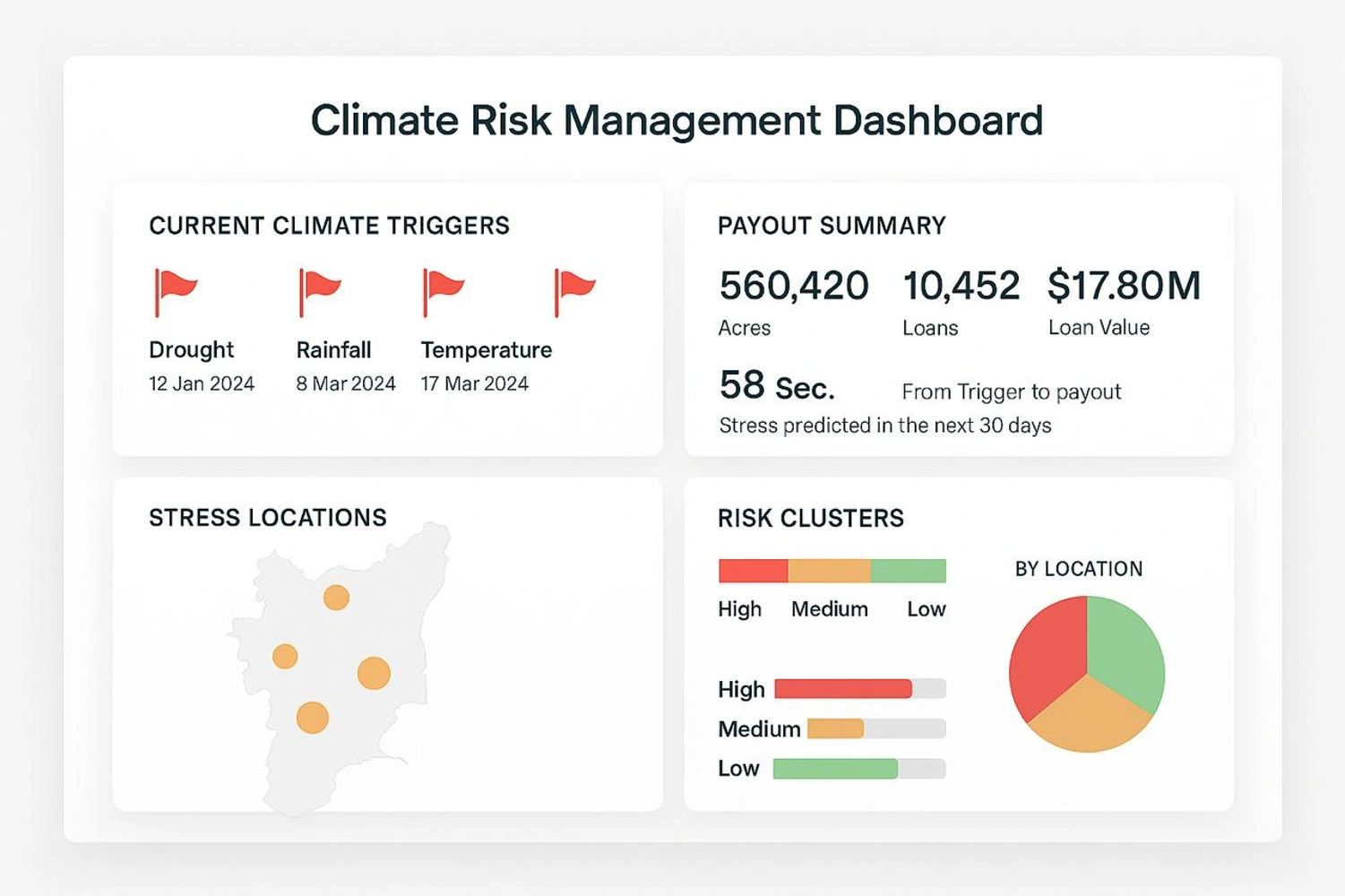

Real-time climate triggers, portfolio dashboards, and regulator-ready audit trails—so you can act before defaults, not after.

Real-time climate triggers, portfolio dashboards, and regulator-ready audit trails—so you can act before defaults, not after.

Predict the spike. Protect the book.

From climate noise to capital signals.

See triggers early. Provision smarter.

Real-time triggers, audit-ready dashboards, and coordinated workflows—so banks, NBFCs, insurers, and DFIs can act before defaults, not after.

Real-time weather-linked triggers and portfolio dashboards for credit, risk, and ESG teams.

Signal validation for carriers and reinsurers—faster, defensible decisions.

Configurable approvals and notifications between lenders, insurers, and DFIs—without handling money.

Quote, simulate, and document parametric covers, without broking or handling funds.

SaaS license only (HSN/SAC 998314).

No commissions. No underwriting. No fund custody. You place policies via your own licensed entities.

Reesecure provides software dashboards and APIs for climate-risk intelligence.

We do not provide loans, deposits, insurance, or hold/disburse funds.

Payments collected are for SaaS access only (HSN/SAC 998314).

💬 FAQ

Is Reesecure a lender or insurer?

No. We’re a SaaS platform. Licensed partners make credit/underwriting decisions and handle funds.

Do you process claims or payouts?

No. VaultX emits verification signals and evidence per agreed parameters. Disbursement is done by licensed counterparties.

How is it billed?

Monthly/annual SaaS license in INR. GST invoice under HSN/SAC 998314. No refunds post-activation.

What data do you use?

IMD, satellite/remote sensing, local weather station, and customer portfolio data—handled under DPDP-aligned controls.

Do you support claims or payout orchestration without touching funds?

Yes. VaultX Orchestration creates auditable instructions (files/APIs/webhooks) for your licensed bank/insurer/PSP to execute on their rails (e.g., escrow, RTGS/NEFT/UPI/e-RUPI). Reesecure never holds, pools, or disburses money.

Do we need a financial license or sandbox to use VaultX?

No. VaultX is Enterprise SaaS (HSN/SAC 998314). You use your existing licensed counterparties(banks/insurers/PSPs) for any money movement.

How accurate are the climate triggers?

Triggers combine official meteorological feeds with satellite/remote-sensing signals and configurable thresholds. Accuracy depends on data coverage, sensor resolution, and threshold design. We provide confidence flags and backtests so your risk team can calibrate before go-live.

What is UAaS (Underwriting-as-a-Service)?

UAaS = TriggerFlow™: configurable underwriting rules that turn data (rainfall, heat, drought, yield proxies) into verifiable signals for pricing, reserves, or program rules—without field surveys. You control thresholds; VaultX logs the evidence.

Who owns the thresholds and final decisions?

You do. Your credit/risk/underwriting teams define the rules; VaultX executes and logs. Licensed partners make the binding decisions.

What’s the typical onboarding timeline?

Most teams complete a pilot in 2–6 weeks after providing portfolio schemas, target geographies/crops, and thresholds. Complex, multi-entity orchestrations can take longer.

What integrations are available?

Can we export audit logs for regulators and DFIs?

Yes. One-click exports (CSV/PDF/JSON) include inputs, thresholds, trigger rationale, timestamps, and signature hashes. Evidence bundles are designed for board, regulator, and ESG submissions.

What about uptime and SLAs?

Enterprise plan targets 99.5%+ app uptime, with 24×7 monitoring for feeds and trigger pipelines. Data refresh cadences are documented per feed (e.g., near-real-time, daily, weekly).

Where is data hosted? Is data residency supported?

VaultX is deployed on major cloud providers with regional hosting options. India data residency is available on request. All data is encrypted at rest and in transit.

How do you handle privacy and the DPDP Act?

We follow data minimization, role-based access, encryption, and audit trails aligned to DPDP principles. A DPA and processor terms are available with Enterprise.

Can VaultX work without an insurance product?

Yes. Many clients use VaultX solely for early-warning, provisioning buffers, credit restructuring, and ESG reporting—no insurance required.

Does VaultX support program subsidies and ESG fairness analytics?

Yes. Optional ESG modules show subsidy equity, enrollment by farmer segments, payout TAT by cohort, and exportable indicators for DFI reporting.

Can you simulate triggers before we go live?

Yes. Backtest tools run your rules against historical seasons so you can compare expected vs. observed outcomes and refine thresholds.

What happens if feeds fail or conflict (e.g., sensor outages)?

VaultX flags data quality and uses fallback sources where configured. You can require dual-source concurrence or manual review before a signal is accepted.

How many users are included? Do you support roles?

Plans include seat bundles; Enterprise offers unlimited users with RBAC (viewer/analyst/approver/admin) and audit trails.

Can we deploy in our VPC or on-prem?

Enterprise supports private VPC/VPN deployments and strict egress controls. Fully on-prem is evaluated case-by-case.

How does billing work for Orchestration and UAaS?

Do you provide training and change-management support?

Yes. We include enablement sessions for credit, risk, claims, and ESG teams, plus sandbox walkthroughs and policy templates.

Can VaultX help with board/regulator memos?

We provide exportable evidence bundles and memo templates (you own content/filing). Many clients attach VaultX logs to board packs and regulator submissions.

Do you support AP2/A2A/MCP-style mandates?

VaultX can capture mandates/approvals and produce verifiable evidence chains today. As open protocols mature in your ecosystem, we can map mandate artifacts to those specs.

What crops and regions do you support?

Coverage includes major Indian Kharif/Rabi crops and multiple geographies. Tell us your districts/crops; we’ll confirm data readiness and backtest depth.

What’s your dispute posture?

VaultX provides the transparent record: inputs, thresholds, signals, and timing. Your licensed counterparties retain adjudication authority; we help them defend decisions with evidence.

Can we run a small proof-of-value first?

Yes. Most clients start with one state × one crop × one season to establish calibration and ROI before expanding.

VaultX isn’t a “nice-to-have” dashboard—it protects portfolios, speeds decisions, and reduces stress across three modular services.

1) Real-time Climate Triggers

2) Portfolio Risk and MIS/ESG Dashboard

3) UAaS and Orchestration

Note: Results depend on portfolio design, data coverage/quality, governance, and partner readiness.

Who It’s For

• NBFCs & Banks → reduce provisioning; act pre-default

• Insurers & Reinsurers → parametric verification; audit-proof evidence

• DFIs & Public Programs → equity in subsidies; payout fairness; ESG logs

• AgTechs & FPOs → early warnings; portfolio monitoring

🌍 Impact Pathway (2026 and beyond)

• 2025: Dashboard Pilots live with Tata AIG, Samunnati, Novo, Tokio Marine

• 2026: IFSC VaultX pilot with cotton farmers & Samunnati FPOs

• Beyond: Global alignment with reinsurers (Tokio Marine) and DFIs (e.g., AFD) to scale risk capacity

Your subscription today → a seat at the table for tomorrow’s climate-credit rails.

Weesecure Inc is the parent of Reesecure, and is a Hyderabad-based SaaS company building climate-risk infrastructure for institutional credit and insurance.

Programs & pilots with: Novo Insurance Broking, Tata AIG, Samunnati, Tokio Marine, SBI-AFD

Compliance & Trust

Reesecure provides dashboards and APIs for climate-risk intelligence.

• No lending, deposits, or insurance

• No funds handled—only SaaS subscriptions

• Razorpay-safe billing · regulator-aligned reporting

Open today | 09:00 am – 05:00 pm |

Sign up to hear about Reesecure Network's news.

Reesecure provides software dashboards and APIs for climate-risk intelligence.

We do not provide loans, deposits, insurance, or financial intermediation.

All payments are collected only for SaaS access (HSN/SAC 998314).

© Reesecure Network Pvt. Ltd. · Hyderabad, India · GSTIN 36AMRPM1867A1ZX

[Terms of Use] [Privacy Policy] [Refunds] [Compliance]

Copyright © 2025 Reesecure Network - All Rights Reserved.